Safeguard the uncertainties of your life!

It is impossible to predict the future, and even a tiny surgery can cause your savings to plummet. It is true that health insurance will cover the cost of such medical emergencies, but they may fall short of the required amount for a procedure. Furthermore, they exclude cosmetic procedures and come with exclusions depending on the plan you choose. With a medical emergency loan, you won’t need to worry about such a huge impact on your budget. Here are the steps you need to take to get a personal medical loan and how they work.

An emergency loan from a personal lender may be the perfect solution for you if you need financial assistance. This loan can be used for medical treatment, diagnostics, and medication costs, among other things. Furthermore, you will enjoy competitive interest rates if you choose this medical emergency loan. By doing this, you are able to save a substantial amount of money on interest payments. You must meet basic eligibility criteria for the loan, and it offers a quick application process. You can also avail of a top-up loan on your existing personal loan easily with Bajaj Markets.

Medical Emergency Loan Interest Rate

If you are thinking of getting a personal loan for a medical emergency, you must be aware of its interest rates and other charges. Check all the applicable fees in the table below:

| Medical Loans Interest Rates and Other Charges |

| Interest Rate 11% p.a. onwards |

| Processing Fees Up to 4% of the loan amount |

Disclaimer: The interest rate and other charges provided in the table above are subject to changes at lender’s discretion. Check the current rates and charges with the lender before applying.

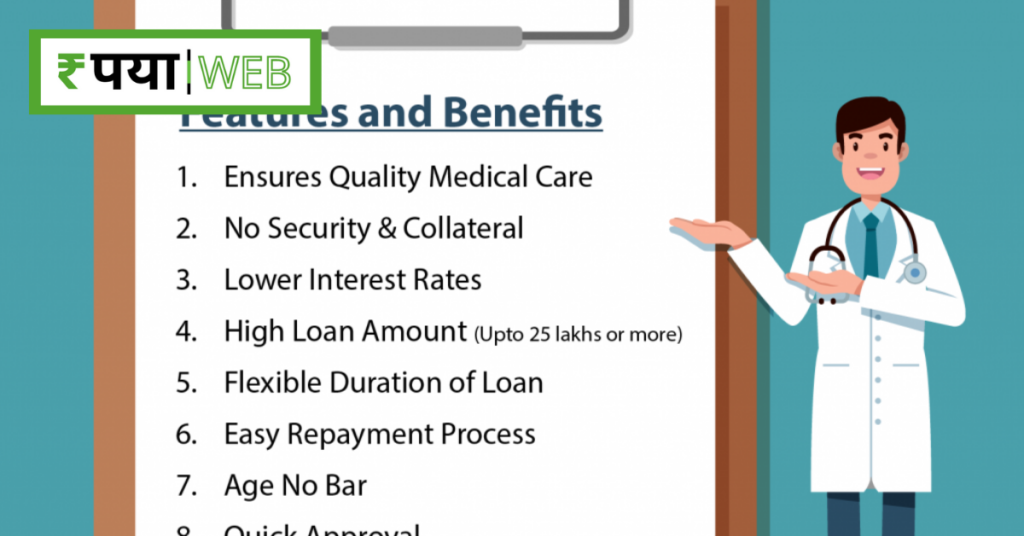

Features & Benefits of a Medical Loan:

High Loan Amount

You can avail of a loan amount of up to ₹50 Lakhs for your healthcare bills. You can use this amount to cover your expenses on medication, treatment, tests, or hospitalisation.

Flexible Repayment Tenure

You can choose a repayment tenure that suits your financial capabilities. You have the freedom to pay off the loan anywhere within 6 months and 7 years.

Quick Approval

Medical emergencies demand that you have the required funds with you as soon as possible to be hospitalised, avail medication and get treated. Most lenders ensure that your loan application is approved within 5 minutes.

Immediate Disbursal

Due to the immediate nature of urgent healthcare, you need an instant loan for a medical emergency. Thanks to the simplified application process, you get the money in your bank account within 24 hours of getting approval. This way, you can address your health straightaway.

Also Read – How To Transfer Home Loan To ICICI Bank

Ease of Repayment

The personal loan EMI or monthly instalment that you pay for this loan is also convenient. With an affordable personal loan interest rate and by choosing the right tenure, you can repay your loan without strain. You can also benefit from the part prepayment facility to clear off your dues before the tenure ends to save more.

Minimal Documentation

Since the entire application process for most personal loans is online, you can avail of this loan quickly and with minimal paperwork. This also helps in completing the loan application and approval process near instantly.

Calculate EMIs for Medical Loan

| Year | Principal | Interest | Balance |

| 2023 Oct Nov Dec | ₹2467 ₹815 ₹822 ₹830 | ₹110 ₹44 ₹37 ₹29 | ₹2533 ₹4185 ₹3362 ₹2533 |

| 2024 Jan Feb Mar | ₹2533 ₹837 ₹844 852 | ₹44 ₹22 ₹15 ₹7 | ₹0 ₹1696 ₹852 ₹0 |

Eligibility Criteria for Medical Loan

To apply for a personal loan for a medical emergency, make sure that you fulfil a few eligibility requirements, which are:

- You must be between 21 and 80 years of age

- You need to be an Indian resident

- You should be a salaried employee at an MNC, a private or a public limited company

- Your CIBIL score has to be 685 or higher

- Your monthly salary must be above ₹25,000

Documents Required for Medical Loan

In order to apply for personal medical loans, you will need to submit the following documents:

- KYC Documents: Aadhaar card, PAN card, Passport, or Voter’s ID

- Employment Proof: Employee ID card

- Income Proof: Salary slips and bank account statements for the last three months

After you submit the necessary documents, the lender will verify your paperwork. Once your application is approved, you will get the money in your bank account within 24 hours.

To apply for a personal loan for a medical emergency, you can follow this step-by-step application process:

Also Read – Bajaj Medical Loan

- Visit the official website of Bajaj Markets

- Go to the ‘Loans’ section and select the ‘Personal Loan’ Category

- Click on ‘Apply For Personal Loans’ to navigate to the application form

- Fill in your personal, financial, and employment details

- Click on the ‘Check Your Offer’ button

- Select your preferred lender from options

- Choose a suitable loan amount

- Submit the required documents to a representative, who will get in touch with you

- Once the loan is approved, you will receive the money in your bank account within 24 hours

Medical emergencies can dwindle your finances when you have to pay a large amount out of pocket. Your healthcare bills can even dent your savings if you decide to use them for this purpose.

To avoid such scenarios, you can avail an instant medical loan. By meeting the simple eligibility terms, you can get funds instantly to meet urgent healthcare needs.

A loan for a medical emergency has got you covered as the lender takes only 5 minutes to approve your application. With the funds in your account within 24 hours, you can address medical needs without compromise or postponing important procedures.